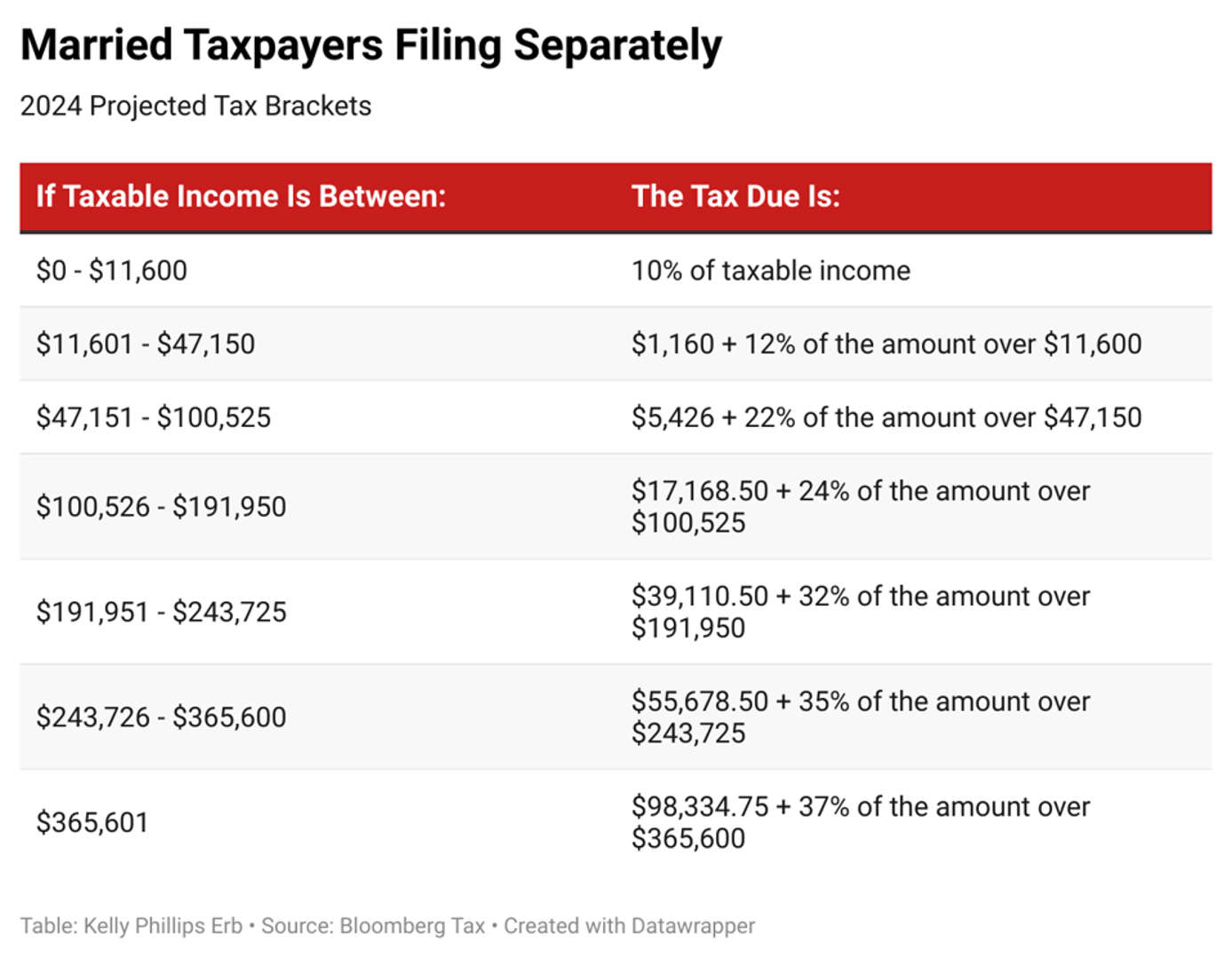

2025 Tax Brackets Married Filing Separately. So as long as you got your marriage license in 2025, you were. Rates for married individuals filing separate returns are one half of the married filing jointly brackets.

See current federal tax brackets and rates based on your income and filing status. Married filing separately is the filing type used by taxpayers who are legally married, but decide.

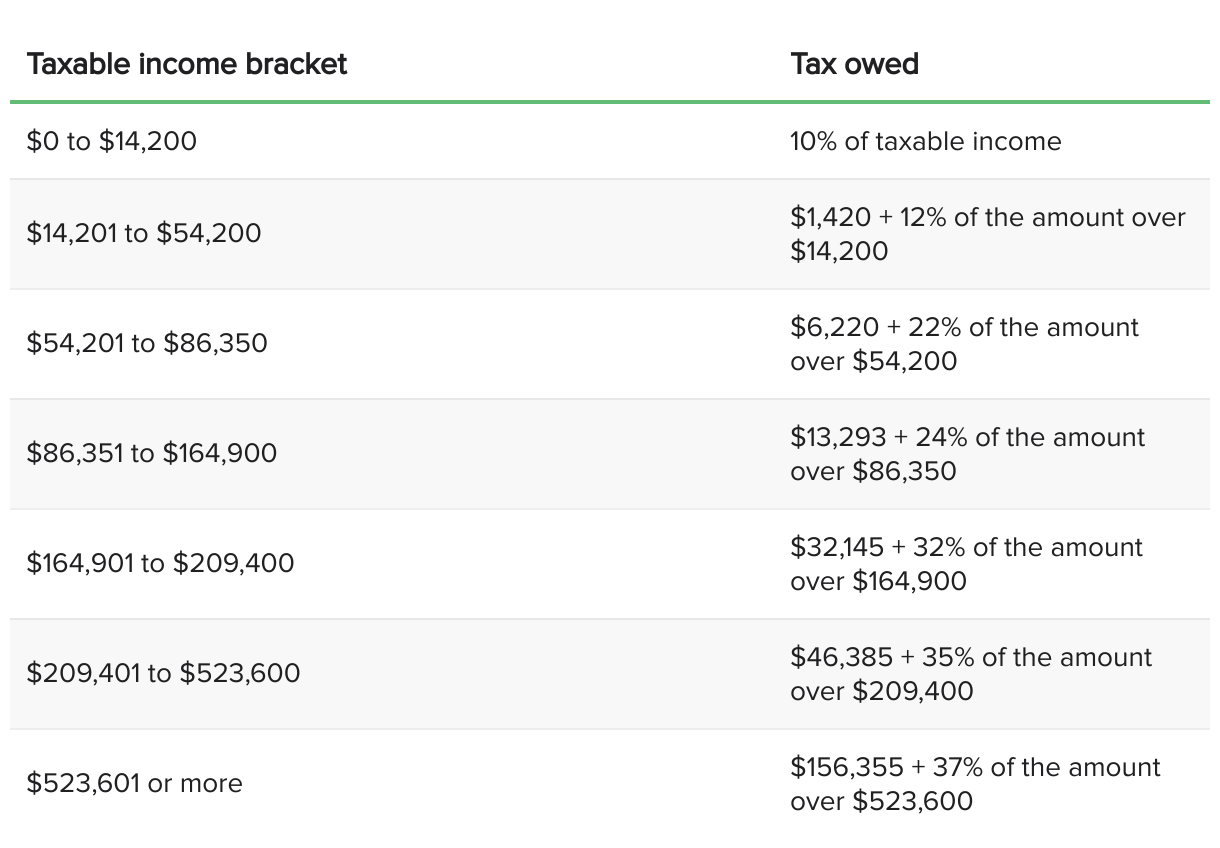

Your taxable income and filing status determine both the tax rate and bracket that apply to you, outlining the amount you’ll owe on different portions of your income.

2025 Tax Brackets Married Filing Separately 2025 Klara Michell, Married medicare beneficiaries that file separately pay a steeper surcharge because. For 2025, inflation adjustments increased the size of tax brackets by about 5.4%.

2025 Tax Brackets Married Filing Separately Married Bria Marlyn, Married couples filing jointly enjoy a tax status where they combine their incomes and file a single tax return. Married filing separately is the filing type used by taxpayers who are legally married, but decide.

2025 Tax Brackets Married Filing Separately Synonym Wylma Rachael, Gains on the sale of collectibles (e.g.,. You pay tax as a percentage of your income in layers called tax brackets.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, When deciding how to file your federal income tax return as a married couple, you have two filing status options: So as long as you got your marriage license in 2025, you were.

What Are The 2025 Tax Brackets For Married Filing Jointly Issi Charisse, For instance, the 22% tax bracket for single filers applies to $50,650 of income for the 2025 tax year (i.e., income from $44,726 to $95,375), but it applies to $53,375 of income for. So as long as you got your marriage license in 2025, you were.

2025 Tax Brackets Married Filing Separately Married Filing Adele Antonie, When deciding how to file your federal income tax return as a married couple, you have two filing status options: Single or married filing separately:

2025 Tax Brackets Married Filing Separately 2025 Hetti, You’re married but you do not file a joint return with your spouse, and instead you both file separately. 2025 tax brackets for married couples filing jointly.

Tax Brackets 2025 Married Filing Separately Wilie Julianna, You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax you have paid in previous tax. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

2025 Tax Brackets Married Filing Jointly Prudi Rhianna, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. When deciding how to file your federal income tax return as a married couple, you have two filing status options:

Your first look at 2025 tax rates, brackets, deductions, more KM&M CPAs, For 2025, inflation adjustments increased the size of tax brackets by about 5.4%. Gains on the sale of collectibles (e.g.,.